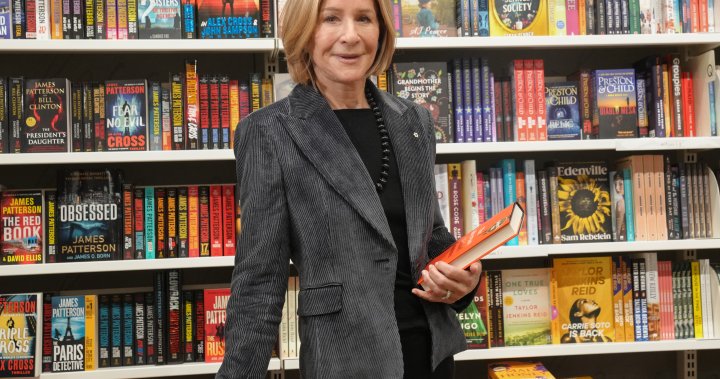

As Canada’s biggest bookstore-turned-gift-giver’s-paradise edges toward privatization, it’s evident from a stroll around one of its Toronto stores that the retailer knows some things haven’t been working.

Epsom salts and body lotions that previously lined Indigo Books & Music Inc.’s wellness area at the Eaton Centre have been replaced by shelves of books and tchotchkes like cat- and corgi-shaped book lights, magnifying glasses and lap desks.

In the children’s section, a red velvet curtain and a closed sign hide what was once the American Girl doll emporium. (The pricey playthings and their plethora of accessories were sold off at a discount in March.)

The company has offered few details about these developments, or a transformation plan it launched late last year — around the same time it revealed an almost $50 million net loss in its latest fiscal year — but such is the state of Indigo at a time when shareholders prepare to decide whether the company is better off as a private enterprise owned by a holding company connected to its largest shareholder.

“It’s a pivotal period to strengthen the company financially and then begin to move it forward,” said Joanne McNeish, an associate professor at Toronto Metropolitan University specializing in marketing.

“This won’t be a quick fix.”

She estimates it will take Indigo five years to turn itself around, a process that marketing experts agree could see the retailer put books back in the spotlight and rethink its spaces and even its store count.

“In the case of the Eaton Centre store, do you need two levels?” McNeish questioned.

“Maybe it’s just each square inch of the floor space doing a great job at selling the products they have available.”

Some of this work appears to be underway already, but how much further it will go depends on a May shareholder vote to decide whether to accept the offer of $2.50 per share in cash — up from $2.25 in February — from Trilogy Retail Holdings Inc. and Trilogy Investments L.P.

The deal got a green light from the retailer’s board in early April and needs to meet the threshold for shareholder approval before it can go ahead.

The email you need for the day’s

top news stories from Canada and around the world.

Trilogy is owned by Onex Corp. founder and chairman Gerald Schwartz who holds 56 per cent of Indigo’s shares and is the spouse of Indigo founder and CEO Heather Reisman, who holds almost five per cent of the company’s shares.

Should the transaction, which would see Indigo leave the Toronto Stock Exchange, close as expected in June, experts say it will be time for leadership to roll up their sleeves and begin a new chapter.

What they will find is that “it’s a lot of work to make this business profitable,” said Grant Packard, an associate professor of marketing at York University. He previously served as Indigo’s interim chief marketing officer and vice-president of marketing.

Between the low margins linked to books, the dominance of e-commerce giant Amazon and a cyberattack that downed some of the company’s services for weeks, he said, “They’ve been under such turmoil for the last few years.”

Understanding the work Packard and McNeish feel Indigo has to do to rebound from that turmoil also means looking at how it got here.

When Indigo debuted in 1996, it speedily became the country’s go-to bookstore, speckling malls, plazas and eventually, the e-commerce world, under Reisman’s goal to create a mecca for book lovers who scooped up books the founder gave her “Heather’s Pick” stamp of approval.

“If they could, they would spend all day there because it’s the equivalent to them of going on a vacation or going to see a movie,” said Packard in describing the target customer.

“There are a lot of people in Canada that are like that, but there are more people that aren’t like that.”

Coping with such demographics, as well as the rise of Amazon and e-readers, pushed Indigo to branch out.

Some of the products it looked to, such as cozy socks and quirky mugs, made sense as book accompaniments. Others — sex toys, furniture and high-end jam — were a much bigger leap.

“Sauces and that sort of thing, they can go bad and then it begins to be not the quality image that I believe Indigo was going for,” said McNeish. “They were never meant to be a discount bookstore.”

Some of Indigo’s diversification began under Reisman but it gained new momentum under one-time John Lewis and Anthropologie executive Peter Ruis. In 2022, he took the helm of Indigo from Reisman, who was made executive chair before she was due to retire in August 2023.

As Indigo prepared for her departure last June, four of Indigo’s 10 directors left the board. Chika Stacy Oriuwa attributed her resignation to mistreatment and a “loss of confidence in board leadership.”

Reisman, who returned as Indigo’s CEO last September, has never elaborated on Oriuwa’s allegations. She revealed last year that the company is carrying out a transformation plan meant to “fully re-energize” its connection to customers.

Since then, an unspecified number of staff were laid off in January and Reisman has said Indigo reinvested in books and has been working to “rightsize and rightshape” its general merchandise in an apparent admission there was a mismatch between customer expectations and what the retailer was offering.

Asked about its strategy moving forward, Indigo said in a statement that it is engaging in “meaningful work” to transform the business and update its range of products.

“Books are the heart and soul of Indigo, and we’re excited to expand our assortment of titles online and in stores across the country,” the company said in an email.

“We will also continue to be the booklover’s gift destination with a very carefully curated offering of lifestyle and paper products.”

An April letter Reisman sent to customers teased that the company would also bring back its digital inventory search kiosks, program more events, add seating to more stores and find café partners to fill spaces in Indigo shops left vacant by Starbucks.

At the Eaton Centre location, a Columbus Café & Co. has filled the store’s coffee shop void and on a recent Wednesday morning, when the weather was too nice to need refuge indoors, had a hearty line. Employees have also worked to expand and freshen the look of the store’s upscale baby section, where several customers browsed.

McNeish thinks the company now has to build on these wins — a task she still feels Reisman is ideal for.

“You can’t be perfect as a manager all the time, but she just seems to have this instinct for how to do it and a deep understanding, as she is a book person herself,” she said.

The trick, Packard said, will be deciding on the right number of stores, how to utilize them and how to invest in its online channels in a way that delivers the company to stability.

“They’ve just been always very susceptible to a market where the winds blow in different directions very quickly,” he said.

“(They need) to be in a position where market shocks like the pandemic or ransomware attack aren’t as deadly, so they can innovate, they can try new things.”