A bid to exit publicly traded markets could give Indigo Books & Music the “nimbleness” needed for the struggling retailer to execute on its comeback plans, according to some analysts.

Shareholders voted Monday in favour of a $2.50 per share offer from Trilogy Retail Holdings Inc. and Trilogy Investments L.P., which already held a 56 per cent stake in Indigo and are owned by Gerald Schwartz, the spouse of Indigo chief executive Heather Reisman.

Some 95 per cent of votes cast from shareholders represented at Monday’s meeting were in favour of the proposed deal, which marks a more than 69 per cent bump in share price from where Indigo’s stock was at the time of the initial offer.

Indigo has said it expects the transaction to close in June and its shares to be delisted from the Toronto Stock Exchange sometime after.

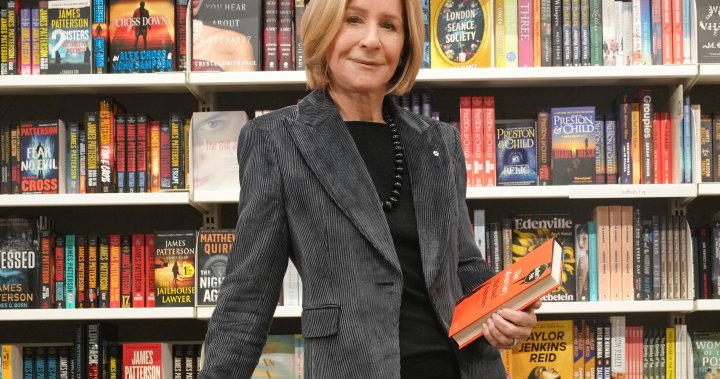

“We are pleased with the result of today’s vote and look forward to continuing our work on Indigo’s transformation strategy,” Reisman said in a statement following the vote.

“We remain deeply committed to our customers and to all our stakeholders as we work together to inspire reading and enrich the lives of booklovers across the country.”

Indigo’s fortunes on the public markets have dwindled since the turn of the millennium, when shares traded for nearly $35 on the TSX.

In recent years, the retailer has struggled to rebound from a cyberattack that knocked down its e-commerce capabilities for months and a management shake-up that saw Reisman return to the helm last September to fill the void left by departing executives and board members.

In its latest earnings report in February, Indigo said third-quarter profits dropped roughly 70 per cent to $10 million from $34.3 million a year earlier.

Revenues for the quarter that ended Dec. 30, 2023 were $370.6 million, down from $422.7 million during the same quarter in 2022.

To turn things around, Indigo has been carrying out a transformation plan since at least November. It’s offered few specifics, but Reisman, who founded the chain in 1996, has said it is meant to “return Indigo to both growth and profitability.”

Manoj Raheja, partner at strategy and consultancy firm Sklar Wilton & Associates, tells Global News that going private allows a publicly traded company to make the changes it needs to for the business to become profitable without worrying about having to file quarterly earnings and respond to shareholder concerns.

“When we go private, we take away the pressures … we’re able to make the right decisions and not trade off for short-term storylines and short-term needs,” he says.

Financial news and insights

delivered to your email every Saturday.

Sklar Wilton & Associates has previously done consulting work with Indigo, but not for the past three years.

Retail analyst and author Bruce Winder says that Indigo has some “tough work” ahead of it, which can be difficult to accomplish in the public eye and could have led to an even steeper dip in valuation if not for the privatization bid.

Indigo can also move faster without having to worry about getting stakeholder approval for whatever pivot the ownership team feels can salvage the business, he says.

“That definitely gives them the nimbleness they need to make some pretty drastic changes.”

What is Indigo’s ‘customer promise’?

For Indigo’s ownership group, taking a company private also means putting a significant investment in the retailer – both upfront and going forward to turn the business around, Raheja says.

Whether a company is private or public, Raheja says successful retailers have to be “maniacal” about keeping their “customer promise.”

Companies like Costco and McDonald’s know this truth well, he says, and are diligent about pushing back when “the Street” – shorthand for shareholders and analysts in the stock market – puts pressure on an operator to squeeze margins at the expense of the customer, he says.

“Regardless of the Street, you have to put your customer at the centre of everything,” he says.

What exactly that “customer promise” is has shifted for Indigo in recent years.

When Amazon burst onto the scene and took an enormous chunk of the bookselling space with its innovative online retail channels, one of Indigo’s responses was to shift into lifestyle goods.

Winder says that while the company might’ve seen some initial traction in the space, interest dried up and the vertical “became a burden for them.”

Winder says that as Indigo weighs its turnaround plan, there is likely an opportunity to cut back the retailer’s physical footprint. With renegotiated leases with landlords and suppliers, Indigo could save on critical cash in the turnaround, he says, and could end up trimming the size of its workforce through layoffs.

“You’ll probably see, maybe a smaller footprint, potentially a more focused footprint that’s much more about books and much less about lifestyle products,” he says.

The Canadian Press notes that some Indigo stores have lately seen wellness products and the popular American Girl dolls culled from their shelves and Columbus Café & Co. has moved into some Indigo spaces previously held by Starbucks.

Reisman has also pledged in newsletters to bring back its digital inventory search kiosks, program more events and add seating to more stores.

What future Indigo stores look like could depend in part on the success of the new flagship store unveiled last fall in Toronto’s The Well development, Winder adds. Reisman pitched that redesigned concept store as a space for kids to do arts and crafts while a jukebox played in the background.

Winder says that while a few Indigo stores across Canada could pull off the kind of cultural and experiential pivot imagined in The Well, he believes the way forward for the brand is likely less “pomp and circumstance” and a refocus on how to be “best in class in books.”

Raheja says forging a new customer promise will mean targeting a specific group where Indigo sees growth potential. That could mean new parents on maternity and paternity leave looking for a place to escape, retirees in Canada’s aging population or even current workers with remote and hybrid arrangements who are looking for a change in scenery.

“I won’t pretend to know which group they want to bring in, but I would say the opportunity is to serve those groups, create programming that is going to deliver on their promise,” he says.

That’s easier said than done, Raheja notes, with increasing competition for Canadians’ time. But a compelling new purpose for Indigo, in his mind, could be enough to restore the company to its former glory.

“There’s zero doubt in my mind that a retailer with Indigo’s background, with its image in Canada, that it can be successful,” he says.

Winder says the challenge ahead of Indigo remains steep, even as a private company. Younger generations are increasingly comfortable buying online, and Amazon will likely remain the go-to destination for this future force in commerce.

He wishes Indigo “nothing but the best” but adds “unfortunately, the landscape’s changed since when they had their heyday.”

With some nod to the creative spark that Indigo has sought to inspire, however, Winder says it would be unwise to assume exactly what’s in store for the retailer’s next chapter.

“That’s the fun in retail, you never know what’s around the corner.”

– with files from The Canadian Press