Nvidia shares dipped in premarket trading on Tuesday after having more than tripled in value in the past year, as the dominant AI chip supplier unveiled its latest flagship product that is expected to further cement its lead in the industry.

Shares of Wall Street’s third most-valuable firm were down about one per cent, with some analysts saying investors had already factored in the launch and were looking out for more details.

“If the brand-new Blackwell chip didn’t trigger a fresh rally, it’s because the arrival of a new and a more powerful chip was already priced in,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

Shares of other chipmakers also fell. Super Micro Computer was down 1.5 per cent, while Advanced Micro Devices shed 1.7 per cent and Marvell Technology dropped 2.2 per cent.

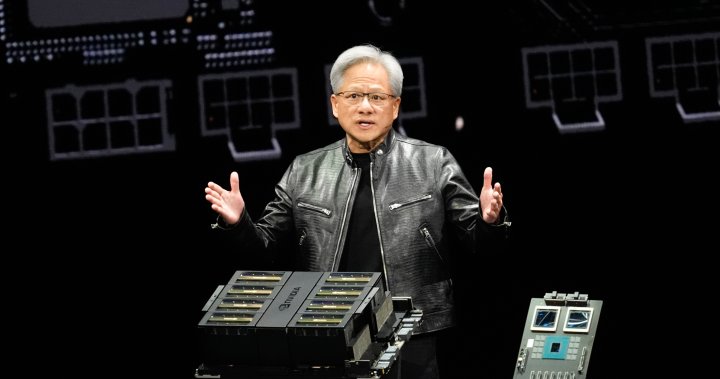

Along with the B200 “Blackwell” chip, the company detailed a new set of software tools at its highly anticipated annual developer conference on Monday, to help developers sell artificial intelligence models more easily to firms that use Nvidia’s technology.

Financial news and insights

delivered to your email every Saturday.

Financial news and insights

delivered to your email every Saturday.

The flagship B100 chip, which binds together two squares of silicon the size of the company’s previous offering, is expected to be used by Amazon.com, Alphabet’s Google, Meta Platforms, Microsoft, OpenAI and Tesla.

Nvidia is also shifting from selling single chips to selling total systems.

“It will take time to evaluate the performance claims for Blackwell, but… the company’s ability to raise the bar this much leaves them in a very strong position,” analysts at Morgan Stanley said in a note.

Many analysts expect Nvidia’s market share to drop several percentage points this year, as new products from competitors are launched and the company’s largest customers make their own chips.

However, Nvidia’s market dominance is expected to remain unchallenged.

The firm, which has cornered 80 per cent of the AI chip market, is expected to provide more details on pricing as well as the transition from H100 to B100 chips at its presentation for financial analysts at 11:30 a.m. ET (1530 GMT) on Tuesday.

Nvidia’s forward price-to-earnings ratio, a commonly used metric to value stocks, stood at 34.6, below its three-year average of 42.